"In the end I believe Walmart and the other big retailers can and should be able to beat Amazon. Just like Dell could have and should have beaten Asus and just like Sears could have and should have beaten Walmart."I concluded because of the huge logistics and retail head start Walmart had they could beat Amazon at their own game. I also, however, posited the problem Walmart would have - the ability to innovate and brand. Here I said:

"The problem for companies like Wal-Mart and other retailers is they are losing the "branding" war. The name "Amazon" is becoming synonymous with on line shopping. People I talk to really do not "shop" on line they just go to Amazon to buy what they want. It is becoming what Marissa Mayer (New CEO of Yahoo) calls a "daily habit". As a consumer, you decide whether you are going to go to a store or buy on line. If you decide to buy on line you go directly to Amazon. I am sure Wal-Mart has all sorts of statistics that try to pat themselves on their backs but reality is Amazon is building a brand which equates to on line shopping - The Amazon brand is to on line shopping what the term "Xerox" is to copiers. If this hole gets too deep, Wal-Mart may not be able to dig out. "Then, it appeared Walmart "awakened" and I wrote a post titled: "Welcome Back Wal-Mart: We Missed You Over The Last 5 Years". In this article I discussed how I went to a Walmart and also used their on-line e-commerce system. Both experiences were extraordinary and this posting was written about 1 year ago.

Today, I have seen the future and it is, in fact, in Walmart. I am more convinced then ever they will win this as long as they stay hungry, scrappy and focused on the customer. In my local Walmart they recently added the giant "Pick up Tower" which essentially is an automated way for you to buy products, have them brought to the store and have a very seamless and frictionless way of getting them. A picture of this is to the left. Because just about everyone in America goes past a Walmart just about every day, ordering on line and picking up in the store is essentially a no-brainer. Can Amazon do that? Sure in the few Whole Foods stores, maybe, but not at the scale a Walmart can do it in.

Today, I have seen the future and it is, in fact, in Walmart. I am more convinced then ever they will win this as long as they stay hungry, scrappy and focused on the customer. In my local Walmart they recently added the giant "Pick up Tower" which essentially is an automated way for you to buy products, have them brought to the store and have a very seamless and frictionless way of getting them. A picture of this is to the left. Because just about everyone in America goes past a Walmart just about every day, ordering on line and picking up in the store is essentially a no-brainer. Can Amazon do that? Sure in the few Whole Foods stores, maybe, but not at the scale a Walmart can do it in. So, think of this scenario. You "shop" on line at night after work and in front of your T.V. You set to pick it up tomorrow at the local Walmart. On your way home from work you swing past, you pick it up and voila.. it is at home. So, why is this so intriguing to me? Well, it is because there are a few external events occurring in the retail / e-commerce space which are converging and making the pure e-commerce play more difficult. They are:

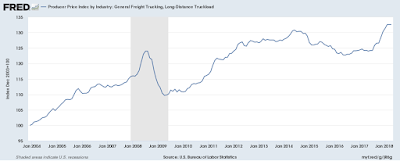

1. Rising Cost of Transportation: Who does not know about this topic? The way to mitigate high costs of transportation is to keep trucks "fullest the furthest" and don't break them down until you absolutely have to. This allows for far more efficiencies when delivering to stores than to people's homes.

2. The Rise of "Porch Pirates": This is a very interesting phenomena where people just go around to houses and steal delivered goods. If you live in an apartment complex, it is like the wild wild west. Between people stealing and boxes being left at wrong buildings and doors, it is a true mess. Many companies are trying to solve this with "lockers", ability to go into your home, delivery to trunks etc. but net net, it all adds cost and complexity to the delivery system. The simple solution already exists - deliver it to a store.

3. Infrastructure Costs: Without a store network, the cost of building out a really good e-commerce infrastructure are astronomical. The Home Depot, which already has one of the best supply chains in retail and has 2200 stores is about to spend over $1bl to build out what they believe they need for same day / next day service. Imagine if you are starting from scratch?

4. Inability of Small Package Carriers to Deal With "Surge" Periods: Finally, we hear this every Christmas season - one of the two major players will have "guessed" wrong and either they lose their shirt in terms of cost or they have not nearly the capacity needed to service the boxes.

In the end, this is Walmart's game to lose and it appears they have no intention of losing. I personally use both and am a "Prime Member" however when that comes up for renewal I think I will be rethinking that automatic sign up. From a supply chain perspective, I believe Walmart is better situated than any other retailer in the business for the following reasons:

1. A very mature small box, big box and cold chain distribution network already in place. They have a huge head start.

2. The ability to service an "endless aisle". With this mechanism you could buy anything from them even if they never stock in the store.

3. Prime real estate for retail. Any chance you do not drive past one?

4. Walmart Pay: I have not mentioned this but the ease of paying using Wal-Mart pay is truly incredible. Also, it does not use NFC but rather QR codes which means all phones essentially can use it (Google Pay and Apple Pay require NFC which is in higher end phones).

The battle continues but right now, due to the maturity of the supply chain, I am leaning to Walmart.