I am traveling for the last time this year and when I am on the road I get to reflect a lot on what is actually going on within supply chains and what we can expect into the future. Here are some things I have reflected on and believe for 2022:

Disruption is not Going Away:

Short of a major economic turndown, the container issues, ship issues, port issues, driver and transportation issues all will continue through 2022 and into 2023. There is no evidence that until significant ship and container capacity comes on line (2023) there will be much improvement. As we have learned this last few weeks, the “appearance” of improvement has been somewhat of a mirage. Ships are slowing down and they are at anchor just further out at sea.

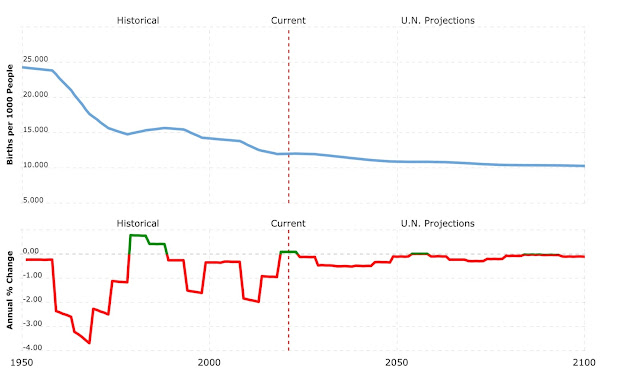

COVID Is Moving from a Pandemic to an Endemic:

The definition of an endemic is something that is around us and never going away. Covid will be around us, at a baseline level for the foreseeable future. The next time you hear someone say to you, “When this is over… “ , remind them we are going into our 3d year. This is the “way it is” and masks, vaccines and therapeutics will be needed likely for the remainder of my life. Supply chains cannot “wait until this is over “ to implement change and execute process improvements. We have to learn to work within it.

Shippers Will Continue To Take More Control of The Assets:

We all have seen the stories of big companies leasing ships but who would have thought a large furniture company would buy a large trucking company? This is a perfect example where shippers will be adjusting their supply chains to deal with the massive margin inflation in purchasing of supply chain services. It takes a while but supply chains will adjust. Product will be on-shored, assets will be insourced, and networks will be redesigned to adjust and mitigate the inflation.

This was started by Amazon when they bought Kiva Robots and they have progressively taken control of their own destiny. Amazon will surpass UPS and FEDEX as the largest package shipper (on their own assets) sometime next year. The massive margin inflation passed to shippers this year is not sustainable and it will end.

We Will See 3 Interest Rate Hikes in 2022:

This is breaking news as it was today the Fed had their press conference after the December FOMC meeting. You decide what this means for your business but suffice to say the “punch bowl” is going to be removed from this economy. I personally believe this will mean a number of “zombie” companies will struggle to survive. The easy money will be gone and companies which generate no profit will not continue to be valued at such high levels as they are today.

A Few Charts:

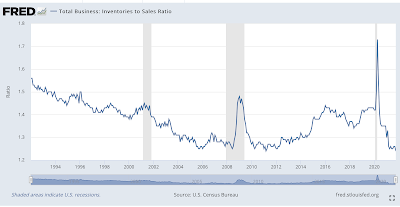

Those who know me know I track the FRED Inventory to Sales ratios as an indicator telling us what stage the restocking and the “normalization” of supply chain is in. The news is that we are still dramatically lower than we need to be and this means restocking will continue for the foreseeable future (See Disruption is Not Going Away above):