I am sure many in this community follow Craig Fuller from Freightwaves. I thought this was a very good interview on Bloomberg so I thought I would post it here.

Wednesday, January 19, 2022

Sunday, January 16, 2022

What Separates "Vital Few Metrics" from "Nice to Know" Metrics - And What Can We Learn from Tom Brady...

I was reading an article about Tom Brady today in the Washington Post and it led me to think about metrics in supply chain. How could that possibly be, you ask? What does how a quarterback preforms in football have to do with supply chain?

First, in case there are those who do not know who Tom Brady is I would just ask you to google him. Whether you like him or not as a fan you have to respect all that he has accomplished. We literally likely will not see another like him in our lifetime, or maybe ever, as it relates to football and longevity. 9 super bowl appearances, 7 titles and 13 AFC Championship games. When everyone thought he was done, he went off to Tampa Bay where he promptly won another super bowl. ( I will not list them all here but if you want to know all the records he holds, I found this website).

The article in the Washington Post was titled: Tom Brady is telling his own story and doing it at his own pace: (May require firewall). The general theme was the success of Tom Brady (Besides raw talent - which a lot of NFL QBs have had and have been far less successful) can be boiled down to just a few items:

- His ability to focus on the mission in front of him.

- His ability to ignore all the noise around him in terms of success (fan noise, social media noise, trappings of fame noise).

- His discipline in controlling his time. Everyone wants a piece of his time but he rarely provides it. He does not have to be everywhere.

- They are inwardly focused and not from the view of a customer

- The critical few are not separated out from the "nice to know"

- They do not have one or two (no more) clear outcome metrics. Using our football analogy, think of the outcome metric as the score of the game. All the individual stats that are produced (proudly by AWS) during the game are just input or driving metrics. They only matter if they indicate and predict what the outcome of the game will be.

Wednesday, December 15, 2021

Supply Chain Update - Hint: Disruption is Not Going Away and as The Who Warned Us: Don’t Get Fooled Again

I am traveling for the last time this year and when I am on the road I get to reflect a lot on what is actually going on within supply chains and what we can expect into the future. Here are some things I have reflected on and believe for 2022:

Disruption is not Going Away:

Short of a major economic turndown, the container issues, ship issues, port issues, driver and transportation issues all will continue through 2022 and into 2023. There is no evidence that until significant ship and container capacity comes on line (2023) there will be much improvement. As we have learned this last few weeks, the “appearance” of improvement has been somewhat of a mirage. Ships are slowing down and they are at anchor just further out at sea.

COVID Is Moving from a Pandemic to an Endemic:

The definition of an endemic is something that is around us and never going away. Covid will be around us, at a baseline level for the foreseeable future. The next time you hear someone say to you, “When this is over… “ , remind them we are going into our 3d year. This is the “way it is” and masks, vaccines and therapeutics will be needed likely for the remainder of my life. Supply chains cannot “wait until this is over “ to implement change and execute process improvements. We have to learn to work within it.

Shippers Will Continue To Take More Control of The Assets:

We all have seen the stories of big companies leasing ships but who would have thought a large furniture company would buy a large trucking company? This is a perfect example where shippers will be adjusting their supply chains to deal with the massive margin inflation in purchasing of supply chain services. It takes a while but supply chains will adjust. Product will be on-shored, assets will be insourced, and networks will be redesigned to adjust and mitigate the inflation.

This was started by Amazon when they bought Kiva Robots and they have progressively taken control of their own destiny. Amazon will surpass UPS and FEDEX as the largest package shipper (on their own assets) sometime next year. The massive margin inflation passed to shippers this year is not sustainable and it will end.

We Will See 3 Interest Rate Hikes in 2022:

This is breaking news as it was today the Fed had their press conference after the December FOMC meeting. You decide what this means for your business but suffice to say the “punch bowl” is going to be removed from this economy. I personally believe this will mean a number of “zombie” companies will struggle to survive. The easy money will be gone and companies which generate no profit will not continue to be valued at such high levels as they are today.

A Few Charts:

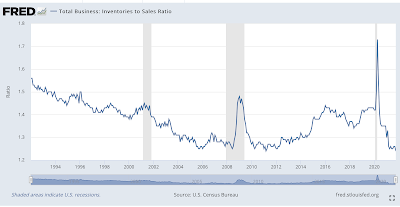

Those who know me know I track the FRED Inventory to Sales ratios as an indicator telling us what stage the restocking and the “normalization” of supply chain is in. The news is that we are still dramatically lower than we need to be and this means restocking will continue for the foreseeable future (See Disruption is Not Going Away above):

Friday, October 22, 2021

Thursday Note on THE Supply Chain - Birth Rate in The United States

This is just a quick note on some learnings from the last few days. While there are a lot of issues in supply chain which are well documented both here and other places (i.e., international capacity, truck capacity, shortages of materials etc.) the single biggest issue I hear from all my peers is the labor issue. So, why is this such a big issue?

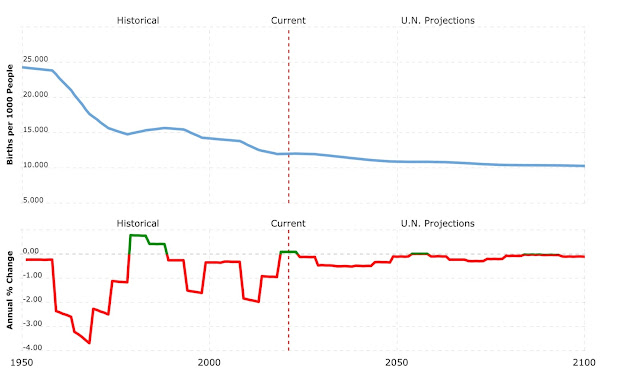

First, it appears to be a very systemic issue which is pervasive and has no easy fix. A lot is discussed about pay rates but the reality is America is running out of workers. it is simple math. The chart below from MacroTrends (Source United Nations) shows it clearly:

Wednesday, October 20, 2021

Wednesday - Mid Week General Thoughts

Here is just a quick summary of some things I am looking at this week and also some things which just make you go ... hmmmmmm:

- California Ports 24-Hour Operation is Going Unused - WSJ). So far the 24 hour out gate at the ports of LA/LB are considered a total bust. Unfortunately, those making these rules don't understand the "chain" in supply chain. It is not just about time available. It is about trucks, drivers, port space, all sorts of workers, chassis and a myriad of other things. If nothing is done on those fronts, the chain breaks and no amount of extra "open" time will fix it. More to come but so far I rate the 24 hour port plan a F-.

- Driving up and down the highways at night allows you to see a big part of the problem. Trucks parked all over the highway as they run out of hours and there is no parking for them. Is anyone addressing this issue? Does anyone think that parking on the side of the road, with no facilities and with no safety will attract people to the trucking industry? Remember, for in trucking for every "machine" you employ you have to employ at least one person. It is not like manufacturing where a "machine" eliminates the need for a number of people. In trucking the capital employed to human is 1:1. Treatment of Drivers: F.

- Anyone been to Costco lately? I have been in one in Michigan and one in Georgia recently and guess what? The toilet paper shortage appears to be coming back. This time I think it is more about lack of trucking capacity than anything. Come on Costco, you can get restocked!

- Inventory to Sales Ratios both total and just retail show little to no improvement. This means my "when will this get better" meter is moving to the beginning of 2023 when I had it pegged at mid year 2022. Still not coming off of the 2022 but the likelihood of it going into 2023 is getting more real. Likelihood of a quick resolution to the supply chain issues in America ending soon - D

Total Inventory to Sales: - Port of Savannah is still the best port out there by far however it has been "found" by some big retailers who are slow to move their boxes off the port. This has meant some ocean carriers have cancelled calls to Savannah and added the Ports of Jacksonville and Charleston. I think just about everyone is starting to look at "over the water" movements to the East Coast versus getting into the mess of LA/LB then trying to move it over ground. Port of Savannah is an A

- JB Hunt (Stock information: JBHT)is the best run trucking company in America by far. They knocked their quarter out of the park and they have even better days ahead. They have transformed from an old school, irregular route trucking company to a high tech, well disciplined supply chain company. And, the market is rewarding them for it as they have a P/E that values it like a tech company and just about everyone upgraded their stock this week. YTD J.B. Hunt is up 44.64% as compared to Schneider (SNDR) who is up 19.7%. (See comparison chart here). JB Hunt is an A+

- Costs continue to rise in all facets of the supply chain: Various data sources tell us that yes Virginia, there is inflation, and a lot of it.

- Why is the market not putting capital into asset companies? Just today another $200M investment in a tech company that is supposed to help you find a truck. So, we keep building apps but we don't staff trucks. Not helpful but the folks doing investing must know something I do not know.

- Should there be a reserve corps for Supply Chain Professionals? I am really thinking we need this. People join just like you would join the Army reserve except it is a national supply chain corps. You would get the same protections the old "Soldiers and Sailors Relief act" provided and you would get called up as needed. This would accomplish the same thing as calling up "the military" but you would get a lot more professionals to join as they would not have to do all the "Army Stuff"

Sunday, October 10, 2021

This is Not Just COVID - Supply Chain Disruption Has Been Building for Years

I will not bore you with all the pictures and the discussion of how many ships are off the coast of LA waiting to get unloaded. If you are reading this, you already know that fact. What I do want to discuss is the real problem with supply chains and the root cause of this mess.

My fear is everyone is attributing everything to covid-19 and covid-19 certainly did not help. Covid-19 dramatically changed the buying patterns across the world (from experiences to things) and that impacted supply chains tremendously. However, like a lot of things related to covid-19, the impact merely accelerated a trend which was already growing. My thesis is this: The infrastructure of global supply chains was cracking and breaking and Covid-19 sped it up. What is included in infrastructure:

- Driver capacity

- Lack of investment in highway infrastructure (just look at the trucks parked all over every night)

- Lack of investment in port infrastructure

- Lack of connectivity in systems (i.e., you book a container to come to the US but the people on the ground don't know when or even if it is coming)

- Lack of a cohesive strategy on chassis management

- Massive disruption and economic distortion with "on again and off again" tariffs.

- Lack of investment in real assets. A lot of money going into apps and other systems for visibility etc. but what we need our trucks, drivers, trailers, containers and ships.

Wednesday, May 19, 2021

Is the Chief Supply Chain Officer now A Chief Crisis Manager

The last two years have been incredibly challenging for anyone in supply chain. It started with a supply disruption out of China in late 2019 / early 2020. We then went into a demand crisis in April / May of 2020 and then for many industries it very quickly turned right back to a supply crisis. Both with inventories being low and then the entire country trying to restock at the same time which led to too much demand and not enough capacity to move global products. Even US based products were effected because whether made in the US or not, many of the components come over seas.

One hidden part of the capacity issues was the fact that passenger planes stopped flying. In the "belly" of passenger planes flies a lot of cargo and when those planes stopped flying, cargo which normally went by air had to find another way to travel. This added to the supply chain issues.

Much of this has been covered and many articles written so I will not rehash them here. However, what have we learned? What will we do differently? The first thing I think about is crisis management. It turns out, if you are going to be a great supply chain leader, you need to be a crisis manager. That has somewhat always been the case but in the last two years it has gone "mainstream". So, what does it take to be a good crisis manager. Here are my 4 learnings from the last few years:

- Honesty - Be Honest and Straightforward in Communication: This is akin to the idea that you will never solve a problem or deal with a problem unless and until you face up to it and admit it. In your company you need to honest with your executives, your associates, sales and even, yes, your customers.

When these supply issues hit hard two companies stood out: Peloton and Ikea. Both companies went public early on, described what the problem was, what they were doing about it and what people could expect. "Bad news does not get better with age" applies here.

This also applies to associates. Make sure you are honest and straightforward with them as well. - Be Calm and Do Not Panic: Panic is a flight response to an issue that is somewhat embedded in our DNA. However, we as humans can control our responses to anything. This is the time when you have to lead with calmness and strength. Stay focused on the mission(s) at hand. Focus on solving problems.

- Be Decisive: You will not have all the facts by the time you need to make a decision. You need to get as much data as possible but when the time comes you are going to have to "make a call". And this is where the job can get lonely - YOU need to make that call. As Matt Damon says in Ford v. Ferrari, "You cannot win a race by committee". You then need to have all your antenna up to read new and conflicting information, synthesize it quickly and adjust if necessary. Procrastination is not a decision.

- Provide a Vision of the Future: Most people understand when a crisis hits and they understand the work is going to get difficult and they are OK with working incredibly hard if they see what the end vision looks like. For example, out of this pandemic and supply chain crisis we will have actions in place to get us through even more difficult times should they come up in the future. The company is going to do great when the consumer hits the great reopening period. Those are two examples of hope and vision.

Monday, March 29, 2021

What Does The Ever Given Episode Teach Us?

Many have focused on the Ever Given episode as a symbol for the dangers of international shipping. Some have discussed it in terms of "choke points" such as the Suez Canal where when one thing goes wrong entire supply chains are disrupted. And, some have taken it as an opportunity to discuss the topic of the size of the ships. Have ships become too big? What happens when there is a problem with a 20K TEU ship?

All of these are very important questions and are being addressed however I believe the question is even bigger. It is about how we structure our supply chains. It is about the age old debate of efficiency v. resilience. Basically, how much insurance are you willing to buy to mitigate the potential of disruption?

Start with inventory. What is inventory? As I have discussed previously, inventory is merely a buffer of product to substitute for the lack of perfect information. In fact, Lean teachings tell us that inventory is considered waste. What do good managers do with waste? They try and eliminate it.

So, as we have done over the years companies have fallen in love with the idea of eliminating inventory because it makes the balance sheet look amazing. But, is inventory really waste?

I submit that inventory is not waste just like your fire and auto insurance is not waste. Think of your insurance policies. You may pay a couple hundred dollars a month for a product you hope you will never use! Wouldn't you consider that waste? Well, not if you are protecting your portfolio you wouldn't.

So, now, let's go back to the Ever Given. The lesson here is we need more insurance (read: resilience) in global supply chains. If we have learned anything in the last year we have learned things will go wrong. Buffer stocks help mitigate this.

The next question is whether we will learn that lesson from this incident. My answer is, I doubt it. Efficiency drives short term results and effectiveness is for the long term. Most businesses will not be able to resist the allure of the efficient. Even if in the short term they sacrifice efficiency for effectiveness most will eventually look for efficiency. Not only are businesses likely to do it on their own but Wall Street will demand it for the publicly traded companies. Another reason private companies will always have an advantage.

What can a supply chain manager do? Well, first, we can strike from our "lists of wastes" the word inventory. Inventory, as I have hypothesized above, is not waste, it is insurance. Second, become a story teller. Supply chains in the age of COVID and Ever Given should be remembered for what they have become - stretched to the limit. The mantra of "Never Forget" comes to mind.

If you have doubt of my position look at my favorite graph (posted here for years) measuring, for the United States, our sales to inventory ratio:

Notice the far right of this graph. Here you will see our inventories in the US relative to our sales is at the lowest point since April of 2012. This is what leads us, as consumers, to scramble for everything.

Let's not make it so every generation has to learn the same lesson. Let's build resilient supply chains.

Sunday, November 29, 2020

Why The Chief Supply Chain Officer Needs to Understand Customer Experience in Detail

Thesis: The Chief Supply Chain Officer (CSCO) needs to be very close to the Chief Customer Officer or whoever in the enterprise is responsible for the customer experience.

Discussion:

This article is for those who are working supply chain within a company that makes or sells things. We know the 3PL world needs to have a customer experience strategy but what about the CSCO within a manufacturer or retailer? Isn't their job to just reduce costs and become "efficient"? NO! For those who have read my writings over the last 5 years you know I believe the single biggest job of the CSCO is to drive revenue. In this day and age you drive it through customer experience (CX) even more than through product.

Let's look at the big advancements which have propelled massive sales growth for key players during the pandemic. A few examples:

- Buy on line and pick up in store

- Buy on line and have curbside pick-up

- Use your smartphone to activate and pay for fuel at key gas stations (I do this a lot at Shell).

- Use of stores as micro fulfillment centers

I could go on and on but all of these are supply chain solutions, empowered by technology to drive customer experience. Notice nothing in that list had anything to do with product but rather had to do with how a customer or consumer acquires the product. If you are back in the supply chain don't think you are immune from this trend because your customer has the same needs as a consumer. They want a frictionless experience to make their business more impactful to the consumer. You can help them with that and that will endear you more to your customer, they will buy more and they will be more loyal. So, a quick conclusion for CSCO's to take action in this space:

- Get to know and partner with the person in your company who is in charge of the customer experience. A lot of times this is in the sales or marketing area.}

- If your company does not have a person who owns this then take extreme ownership and take charge of it.

- Ensure your supply chain strategy supports everything your company is promising in their go to market and customer experience plans. Nothing is worse than a supply chain strategy which is different than the go to market strategy.

- Consistently come back to the customer experience and use data such as net promoter scores (NPS) to determine if your supply chain is meeting the customer expectations.

The customer and the consumer have the power. You will differentiate yourself and your company if your supply chain focuses on the customer experience and "wow'ing" them each and every day.

Post Script: I think of this today and had to write about it industry lost a legend this week: Tony Hsieh. Tony founded Zappos and with it founded a company which was legendary for differentiating itself through customer experience. How do you differentiate the selling of shoes? Through Customer Experience! He built the company from nothing and sold it to Amazon for over $1bl. We should all focus on CX like Tony did.

Rest in Peace, Tony Hsieh.

By Charlie Llewellin from Austin, USA - tony hsieh, ceo, zappos.comUploaded by Edward, CC BY-SA 2.0, https://commons.wikimedia.org/w/index.php?curid=97091081

Sunday, August 23, 2020

There is No "Fast Following" in Today's Technology

There have been a lot of supply chain learnings as a result of the COVID-19 environment and there is nothing more important than the lesson of technology. Technology has separated the haves and have nots in just about every industry. Those companies which have been able to adapt are thriving even in this stressful time. Those who did not have the core technology available, or have been unwilling to invest in the technology, have suffered and many have filed bankruptcy.

As if to prove this case, look at a 4 industries and you will see they have come down to duopolies or maybe three to 5 companies which own the industry. Think of this:

- Home Improvement - Two huge players in Home Depot and Lowes

- General Store Retail - Target and Walmart

- E-Commerce - Amazon and Wayfair

- Pure Technology - Apple, Google (Alphabet), Facebook (Advertising).

- It makes them infinitely scalable. Meaning they can scale to huge sizes and add little to no cost to the company. Their cost per unit decreases dramatically as they grow.

- It allows them to be incredibly flexible and resilient. Think of Walmart and their now infamous scale with pick up grocery business. Walmart e-commerce business is up 97% YoY. This would not even be possible without the underlying technology already in place. There are very few companies in the world which could handle a 97% increase YoY and have any reasonable chance of still functioning.

- It makes the customer experience far better because the technology allows you to customize the experience to the person. You don't need to "group" people but rather, through the technology, you can customize the experience. Someone wants to come into the store, you have a solution for that. Someone wants curbside pickup, you have a solution for that. Someone wants it brought to their home, you have a solution for that. Someone wants the products delivered to the trunk of their car (specific models allow Amazon to open the trunk of your car and put product in it), you have a solution for that.

- Because the technology is cloud based and built on the cloud it allows for the ability to grow dramatically very quickly. Think about this: In December of 2019, Zoom hosted 10 million daily meeting calls. By April, they were up to 300 million per day.

- Technology allows companies to become dominant in their industry.

- Technology allows scale

- Technology allows companies to be resilient in the face of adversity; It actually allows those companies to thrive.

Sunday, May 17, 2020

The Final 3 Feet Have Become The Most Important in The Supply Chain

- A seamless web presence which allows me to buy what is in inventory at the local store. Take payment so there is a complete touchless process when I arrive at the store.

- An alert process which tells me when the order is ready.

- A tracking method, using my cell phone, which tells you when I am at the store and in the parking spot.

- A well established location to park - good signage - easy to find.

- A numbering system on the parking location to make it easy to find me.

- A "through the window" confirmation process (Show ID, Scan email etc.)

- Associates put in the trunk.

- Associates need to be the best customer service people and need to be in full PPE (Mask and gloves).

They almost all fail at the last two which is great customer service at the car. Many stores (including the big ones) have sent people to my car without any PPE and they have leaned over to ask me a question. The entire purpose of this drill is lost when that happens.

- Open the Shell app and it knows I am at the station. It asks me what pump number I am at.

- It then asks me how much gas I want (From a fixed dollar amount to a "fill up).

- I use Apple Pay on my phone to pay (Completely eliminates the "skimming" threat which is where a lot of credit card fraud occurs).

- The app activates the pump and all I have to do is put the nozzle in the car and select gas type.

- Invest heavily in the final 3-5 feet of your supply / value chain. The rule used to be your mission was to get people through the threshold of the store. But now a huge amount of customers will not want to cross the threshold no matter what.

- Technology is your friend - Use it aggressively and substitute in-store upgrades with technology upgrades.

- Always think seamless. If there is a spot the consumer is interrupted in this process fix it with technology.

- Train your associates to forget their political views. Give the customers what they want and they want to feel safe. Masks, gloves and touchless processes do this.

- Take mobile payments. It is almost silly in this day and age that we, as a society, are not close to 100% pay by smart phone / mobile payment. Everything should be paid this way.

Sunday, April 12, 2020

Have Clicks and Bricks Won The Game over Pure E-Commerce

I see this for three main reasons and in this posting I am going use Amazon as the proxy for e-commerce since it is so dominant in that space. A little background on how this idea started developing. I tweeted the following:

The next morning I opened the Wall Street Journal to an article (Posted at midnight and my tweet was at 10:40pm) titled "Will We Forgive Amazon When This is Over" by Christopher Mims (@Mims, Christopher.mims@wsj.com) (May be Paywall). The theme is the same: At precisely the moment we needed Amazon the most, the model failed and it failed big. There are a couple of key areas where it failed and only one could really have been an "unknown unknown":"A casualty of #Covid19 in the Supply chain is going to be #Amazon. With elongated delivery times, missed deliveries and massive counterfeiting, @amazon has become useless. #Bricksandclicks with in-store pick up, curbside car loading and local delivery has won the day.— 10xLogisticsExperts (@Logisticsexpert) April 11, 2020"

- Merchandising and Inventory: This is the big "unknown unknown" and we cannot hold Amazon or anyone fully responsible for this as no one could have seen the massive whipsaw / bullwhip which occurred with certain products. We essentially had a "run on the bank" and ran out.

However, the "bricks" portion was able to respond much faster through limiting amount someone can buy, "senior hours" and other tactics (Not the least of which is just public shame if you are walking out with cases of toilet paper). Amazon just could not get ahead of this and still to this day are not ahead. They essentially have shut down all other "non essential" product lines yet I can still get all that stuff through either BOPIS (Buy on line pick up in store) or just in store at the bricks. - No Customer Loyalty: The big question for the e-commerce providers such as Amazon will be whether they invest a lot into their networks to support a crisis like this or do they chalk it up to a "once in a lifetime" crisis and assume everything goes back to normal. I think it will not go back to normal and the pure e-commerce players will lose customers and not gain them.

Take the Amazon Prime program for example. Many hundreds of thousands have paid for years into that program. Yes, you get free delivery but it also is somewhat of a loyalty program as well. As soon as the crisis hit, prime customers were thrown to the curb. By doing that, many prime customers are asking themselves "What am I paying for" and now that they have had the experience of "bricks and clicks", these customers may never come back. I would imagine Amazon will see a decrease in both Prime customers and customers overall. - The Technology Just Did Not Work: This led to a massively poor customer experience that did not have to be. In fact, prior to COVID19 most discussions I have been in have always started with, "If Amazon can do... (Kind of like, "If they can put a man on the moon why can't....)". This will no longer be the case. No one will want to replicate this. I think most give them a pass on the inventory issues but why is their website so screwed up? Why do I have to click 4 times before I find out either the product is out of stock, it is reserved for first responders or the delivery will be two months from now (Why would they even allow it to be displayed)?

The purchase experience has been awful. The great technology has gone haywire and their "hands off the steering wheel" AI systems failed at precisely the time they were needed. I found websites of other "off line" stores to be far more helpful, far more accurate and far more useful. Amazon is going to have reevaluate this entire problem. Their technology just does not appear to be much better. - Counterfeiting: One item the "bricks" stores have is brand reputation. Nothing makes it into a Home Depot, Lowes, Target, or Wal-Mart store without it being properly vetted to safety, service and functionality. The item has to perform as specified. Yes, there will be some warranty claims but not complete failure. The "E-Commerce" world, led by Amazon, has had this "endless aisle" approach and they purposefully do very little vetting. They claim they are a "platform" not a store (Although I think this is mostly "lawyer speak" so they can defend in lawsuits). This has led to massive counterfeits, items which are displayed but never fulfilled, , items which say they will be fulfilled but it may be 2 months from now etc.

What is worse is the e-commerce players want the "wisdom of the crowd" to sort through it all, figure it out with "star ratings" (Which are easily manipulated by the very people doing the counterfeiting) and then report them. The e-commerce people want the buyer to be their merchandiser as well and not pay us. Bad form.

Monday, March 23, 2020

The Final Three Feet is Really Really Important (As We Are Re-Learning)

A simple idea but not quite as simple in practice. You still see empty shelves in the day, you see aisles blocked because people are restocking during peak shopping times and you see trash (Broken down boxes) etc. cluttering the store. All of these are signs the store has put no planning into how to stock shelves.

| |||

| Store Shelves Being Stocked During Prime Shopping Time |

I will say one of the most sophisticated processes I have seen is at Home Depot. At Home Depot, carts are built at the RDC (Large cross dock) which tell the store exactly what aisle and location on the planograph those products go. Yes, it takes more at the RDC but it makes stocking shelves in the store much simpler. This ensures a few things:

- The store associates can help customers and not stock shelves.

- The cart is there, shelves are stocked and it is gone. Out of the way of the customers.

- Minimizes complex training on the store floor.

Sunday, March 22, 2020

Time for a Supply Chain Reserve Corps

We have also heard the President tell the states this is substantially a state problem and the feds are there to help and backstop. Finally, we are hearing about the shear lack of ventilators and hospital beds when (just a few weeks ago it was "should") a pandemic hit the United States. All of this makes me wonder if this is truly the best way to deal with a national emergency.

By now many of you have also seen the incredible Ted talk Bill Gates gave back in 2015 where he essentially predicted this COVID-19 outbreak. While not predicting this one in particular, Mr. Gates did say something like this would happen. I highly encourage you to watch this:

Here are some key points from the talk (March of 2015):

- The next big crisis will be from "microbes" not "missiles".

- We have insulated ourselves from huge war catastrophes (i.e. a nuclear war or another world war) because we have spent a trillion dollars plus on national defense and the infrastructure required to defend the United States.

- We have a military which can scale up dramatically in a short time to fight or deter a war.

- We should model our fight against microbes after the structure of the military. You have a permanent "active" force and you have a large "reserve" force which can be called up and which actively practices, trains. and stays functional.

So, the question I am thinking about now is if it is time to have a "Reserve Supply Chain Force"? This would be something you would sign up for just like the military reserves. You would have a role / rank, you would go and practice once a month on the weekend, you would do a 2 week summer training and you would be available to be called up if the government activated the reserves. We would have needs for coordination with civilian industry, you would run a huge reserve of trucks, trailers and drivers and you would work for a leader of this organization.

If your civilian job was in an "Essential industry or company" you may get activated but stay embedded in that company to coordinate all the work.

There are a lot of details to work out but perhaps we need this force that can work in the complex civilian world of supply chain and tie it to the needs of a pandemic so we can scale up the supply chain and distribution / logistics network very quickly. What would this accomplish:

- It would allow us to scale up almost instantaneously. Get the expertise in place, get the trucks / trailers along with drivers and immediately establish the infrastructure for leadership.

- It would prioritize the loading of the nation's supply chain after huge "air in the pipe" is created (Think the run on TP). This could be done in conjunction with FEMA.

- It would allow us to train so we are ready right away. By being trained we don't take months to just figure out "how things work".

- Finally, it would establish a professional "corps" which is qualified, ready and willing to get called up as needed.

Sunday, January 19, 2020

Extreme Ownership in Supply Chain Management

This is why Extreme Ownership is so critical for the supply chain manager. There is a saying in the safety world: "You see it, you own it" and that is true for the supply chain manager. You see the issue, you own the issue and since you are going to see just about all the issues you have to take ownership to get those issues solved. Product defects? You will see it in inflated returns - You see it, you own it! Inventory problems (Too little, not enough) the distribution center manager will see that in his/her distribution center - You see it, you own it!

These ideas are built from a fantastic book called: "Extreme Ownership: How US Navy Seals LEAD and WIN by Jocko Willink and Leif Babin. This book is written for all leaders but especially for the supply chain leader. We see it all and therefore we have to own it.

While there are many types of leaders I think one large macro category could be that there are two types: Victim and Owner. The victim is the one who lists off all the things that have happened to him or her and therefore that is whey they cannot get their job done. If only forecasts were better!! If only we made products which cubed better... If only.... .Well, you get the picture. This person sits back and plays the "if only" game as a complainer, not a participant.

The Owner (in the way of Extreme Ownership) sees the issues and regardless of origin takes ownership. Rather than play the "if only" game as a spectator the Extreme Owner takes action to solve the issue(s). If only forecasts were better! - Action: I am going to meet with the head of planning to discuss how I can give an early warning indicator to things which are not selling (Planning is in supply chain but the early warning indicator may come from outside the planning department). If only products cubed better! - Action: I am going to participate further upstream in product development to educate others on the costs of not cubing properly and how we may be able to meet all the customer needs and ensure a cost efficient way to cube transportation conveyances (Design for Logistics).

My advice here is to take ownership and move out of of your "sphere of influence" and into your "sphere of concern" (Covey). Take action, own the issue and work with your other partners across the company to bring to a resolution.

After reading this book and contemplating for over 1 year (Read it last year), I really have concluded this separates out the great from the good. The great take extreme ownership, the others observe and say "If only...".

Thursday, November 21, 2019

What do FOMO and Linkedin Have to Do with Supply Chain Management

First, if you do not know what FOMO is it is the "Fear of Missing Out" and I think it has become the most dangerous marketing tool technology and others have used in a long time. People are not even sure sometimes why they need or want something but what they do know (Thanks to "social media") is everyone else is doing it so I better jump on board before I miss out. Harvard MBA Peter McGinnis coined this phrase and also warned us about the problems it will create for business. In an INC article, it is defined as:

"He used FOMO to describe managers who execute on too many initiatives or follow too many potential paths, out of fear of missing some positive trend or opportunity"The weapon the purveyors of FOMO use in business is LinkedIn. It is here everyone posts about some fancy technology or some convention that you just "must be at" or "must have". Mind you, most of these posts are not practitioners rather they are just advertising. Rather than buying advertising they just create an environment where you feel like if you do not engage you will "miss out".

There is a corollary to this phenomena and it is called FOBO - Fear of a Better Option. This is the other side of the coin which is when managers are inundated with so much information they are behave like a deer in headlights. They freeze. They are waiting and assuming there must be something better out there and so they stop awaiting a "better option".

According the article cited above, FOBO can be a direct result of our "big data" world. We have so much data and so many ways to display it, slide and dice it, and analyze it that we continue to do that figuring if I "slice it one more way maybe the answer will come out". In other words, we keep looking at the data hoping a "better option" will come out.

Both of these are problems. If you are infected with FOMO you will go down every path known and you will end up with too many disjointed initiatives with no clear direction. If you are infected with FOBO you will stop everything. You will not innovate. You will be like your father at Christmas who says "Don't buy that T.V., next year there will be something better". Of course, this is true every year and it leads to inaction and lack of innovation.

My advice is to be careful on your LinkedIn feed and be very careful who you accept invites from. It is full of "advertisers". Stay focused by reading about topics in depth and stick more to the academic world for studies and thoughts about the future. Don't get sucked into these diseases.

If you want to learn more about it, Peter has a Podcast called FOMO Sapiens and you can listen to it on your favorite podcast player.

Thursday, October 31, 2019

Another Tough Report from A Carrier - Schneider Has Tough Q32019

- EPS missed by .02 on Non GAAP and by .11 on a GAAP basis

- Revenue was down 7.7% YoY and missed expectations by $40mm

- Volumes and price were "compressed" and while they stated there was a "moderate" uplift in the seasonal volume the tone of the message was it was virtually meaningless. We have learned this from other carriers: There has been no meaningful "surge" period.

- We knew there were shutdown costs due to the closing of the First to Final Mile business (Which opened to a lot of fanfare about 2 years ago) but I found it surprising they had to impair the value of trucks they are selling. This tells me they are shrinking the fleet and are actually taking losses on the equipment to dispose of them.

- While their truckload numbers are tough to decipher due to impacts of the FTFM closure and the impairment of tractors, both intermodal and logistics (think brokerage) suffered as well. Intermodal was down 2% due to volumes and Logistics was down 13% (Blamed on a major customer insourcing).

- They lowered their guidance from what was $1.30 per share to $1.38 and it is now $1.24 to $1.30. Again, this appears to be due to the tractor impairment charge. Interestingly they lowered their CAPEX for the year which again, indicates to me they are shrinking the asset base.

Sunday, September 29, 2019

Mike Welch - A Legend Passes On

I feel a need to tell the story of how Mike and I met and started working together. In 2004 I was the General Manager of a the Ford Service Parts Business working for Schneider Logistics (SLI). Ford was building out their Daily Parts Advantage service model and asked SLI to somewhat replicate what we were already doing for GMSPO. As the GM I had to find dedicated carriers to make all the deliveries nationwide to almost 5K dealers and we were having trouble finding a carrier in Evansville, Indiana.

Luckily, I had an acquaintance who used to sell truck parts but now owned a company called Segmentz. They were a very small LTL company and at the time Ford wanted to really look at costs and so we took a chance on this small, unknown and very inexperienced company. Right after we contracted with them they purchased Express-1 from Mike Welch. This acquisition is what made Express-1 a public company and it turns out the only real profitable part of the merger / acquisition was the part we contracted with for the Ford Service Parts.

This caused Mike to become President of the combined company and they shed just about everything that was Segmentz. This is how I met Mike. I was living in Novi, MI and Green Bay, WI at the time.

Fast forward to 2005 and I had decided to leave SLI and went to Whirlpool in St. Joe Michigan. One morning I went to get my haircut and who was in the barber chair but Mike Welch! I was shocked as I really had no idea they were based in Buchanan. We talked a lot and it turns out Mike was deeply involved in my son's school and he was a great expedite provider to Whirlpool. This meant I was able to rekindle both our professional work and our personal relationship. So, what did I learn from Mike:

- He was a humble man and he taught me the art of humility. While being wildly successful in the logistics business he never sought the spotlight. He made his business better, he took care of his associates and he made his customer's businesses better.

- He taught me about giving back. While he clearly made a lot of money when he sold to XPO he always took care of the community. He always was there when we needed him for the boys and girls clubs, the Lakeshore Foundation and anything else which would make the community better. He was always there.

- He never forgot his friends. While I considered him a friend I would not say we were super close however every time I saw him you would think we had been friends since grade school. He always had time and he always engaged.

- Finally, he was a great businessman. He was an entrepreneur, he served his customers, he was proud of what he built and he always was innovating. I learned a lot about just down to earth business concepts from him.

Sunday, July 21, 2019

What Have The Tariffs Taught us About Supply Chain?

First, this topic has been talked about for a long time and it goes under the banner of "supply chain disruption". We have always thought of these disruptions as either "natural disasters" (think hurricanes and earthquakes) or "man-made" disasters such as wars. In either case the recommendations have been for supply chain professionals to stay very close to the impact of these and how long a company could survive should one hit. Perhaps this tariff war is a way for us to practice before something we really cannot control occurs.

In 2011 both the hard drive industry and the auto industry were hit hard and interrupted significantly by flooding in Thailand. Closer in time, the graph below from EPS news shows the types and number of disruptions just in the 2017 / 2018 timeframe:

- Plan, Plan, Plan - scenario planning and conducting FMEA's are a must in this environment. You should not have to make it up as you go along when a disruption hits.

- Think about your supply chain as a portfolio. You likely would not invest your entire life savings in one stock would you? Why would you do it with your company's supply chain? Diversity is critical to mitigating risk

- Develop early warning indicators - each with a plan of action if it appears it is happening. As you develop your FMEA you will likely identify a bunch of interruption scenarios along with probability and severity ratings. You will then want to work diligently on the scenarios with the highest likelihood with very severe outcomes. But, it is not good enough to just know them. You then have to determine what the indicators you will begin to look at to determine if something is going to happen. How can you monitor the global situation and determine the likelihood of an event?

For example, on tariffs, this was a topic of the election and the US is doing pretty much what it said it would do during the election. This was a red flag. While you would never have known for certain what you did know is the "likelihood" of supply chain disruptions due to tariffs increased dramatically on January 20, 2017. Was it enough to change everything that day? Probably not. Was it a good time to pull out your disruption FMEA's off the shelf and update them? Absolutely.

Sunday, June 23, 2019

How Can The Market Be at An All Time High and There Be A Freight Recession - Part II

So, how can the stock market be hitting an all time high? I believe it is due to 3 reasons (Warning, I know a lot more about freight than I do about investing but here goes):

- The alternative investment (10yr as a proxy)

- % of the economy which has nothing to do with goods

- The Fed.

This chart compares the Dow Jones Transportation Index to the DJ30 and the S&P500. This is a one year return graph and ends on June 21. As of June 21, the DJ30 is up 6.66%, the SPX is up 7.1% and yet the DJT is DOWN 3.91% Bottom line is investors are shunning transports yet still embracing the overall economy. Why?

The Alternative Investment:

Investors are going to invest. That is what they do and they have two macro alternatives. First, they can invest in the "risk" markets (i.e., stocks) or they can invest in what is generally considered the "risk free" or "near risk free" investment. I will use the 10yr as a proxy for this second grouping. What we have seen recently is not only a 10 year treasury at multi year lows but we are also hearing the Fed discussing lowering the rates even further. This will drive investment dollars away from the "risk free" and into the markets.

It is no coincidence towards the end of last year when the Fed was not only raising rates but also calling for 3 rate hikes in 2019 the stock market tanked. Investors were deciding to move away from risk assets as the risk free was looking pretty good. Not so much any more as the 10yr is now bouncing around the 2% level.

The graph to the left is the graph of the 10 year treasury rates as of Friday, June 21. This movement of rates down has caused money to flow back into the risk asset markets and specifically look at the major move down since mid May. This is when the Fed made it pretty clear the only action they likely will take is a move down in rates.

% of The Economy Which Does Not Have Anything to Do with Shippable Goods:

This one is a bit nuanced. Let's just look at 30 years ago and think about what it meant for the economy to be growing at 3%. It was intuitive that the growth had to have much to do with autos, real hard electronics, housing etc. etc. These are all very "hard" goods which drove the economy.

Today, when we the economy grows at 3% more of it has to do with finance, services and the infamous FANG stocks (Facebook, Amazon, Netflix and Google - Alphabet). Only one of these, Amazon, ships anything. The rest make their money in the "virtual" world. Very important to the economy but not so important to trucking. The graph below illustrates this:

|

| Non Shipment Economy |

- Economy is slowing

- Investors have to invest in the market to get any kind of return due to the "risk free" paying so low.

- Investors are shunning the transports

- This drives the market to records

- Less and less of the GDP has to do with "shippable goods"